30 Jun 2004 _____ 1. This Ruling to the extent that it is capable of being a public ruling in terms of Part IVAAA of the.

New Research Released On Emergency Rental Assistance Program Strategies National Low Income Housing Coalition

TR taxation ruling.

. The letting of the house is a non-business source and the rental income is taxable under paragraph 4 d of the ITA. Offer rental reduction to B for the month April May and June 2020 of RM2500 a month. Rental property - division of net income or loss between co-owners.

LETTING OF REAL PROPERTY. Letting of Part of Building Used in the Business 28. 12 the situations or circumstances where rent or income from the letting of.

A Ruling may be withdrawn either wholly or in. Rent guidelines with leases commencing between October 1 2021 and September 30 2022 were adopted on June 23 2021. We publish many different types of public rulings.

INLAND REVENUE BOARD Public Ruling No. The Board holds an annual series of public meetings and hearings to consider research from staff and testimony from owners tenants advocacy groups and industry experts. I letting of real property as a business source under paragraph 4a of the Income Tax Act 1967 ITA.

In general you can deduct expenses of renting property from your rental income. In 2015 things change you move back out and rent the home once again. 381-384 prohibits the imposition of a net income tax where the only contacts with a state are a narrowly defined set of activities constituting solicitation of orders for sales of tangible personal property.

Where rental income is assessed under S4d rent received in advance is. The IRB has published Public Ruling PR No. For a year is RM500 while quit rent is RM50 a year.

The association will be taxed on the rental income derived from the letting out of part of its premise and the member will also be taxed on the income derived from operating a. Taxation Administration Act 1953 is a public ruling for the purposes of that Part. Taxation Ruling TR 921 explains when a Ruling is a public ruling and how.

If you pay rent by check you may also request. Rental income under paragraph 4d of the ITA is on the date the real property is rented out for the first time. Industrial Building Allowance 28 12.

Based on Public Ruling PR 122018 the rental income is considered to be a business income if you provide support or maintenance services comprehensively and actively to your property. DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA. They express our interpretation of the laws we administer.

The IRS has ruled PLR 2012-29-007 that an S corporations rental income is not passive income under Section 1362 d 3 C i. 12 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. The Inland Revenue Board IRB has issued Public Ruling No.

A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. At the end of 2014 the value of the home remains 400000. 11 the treatment of rent as a non-business source of income under section 4d of the Income Tax Act 1967 the Act.

A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia. 414 Rental Income and Expenses. DIRECTOR GENERALS PUBLIC RULING Section 138A of the Income Tax Act 1967 ITA provides that the Director General is empowered to make a Public Ruling in relation to the application of any provisions of the ITA.

The Inland Revenue Board of Malaysia LHDNM issued Public Ruling PR No122018 Third Edition on 19 December 2018 reported in our e-CTIM TECH-DT 972018 dated 21 December 2018. This PR which supersedes PR No. INLAND REVENUE BOARD MALAYSIA.

For those states that impose an income tax or another type of tax based on income Public Law PL 86-272 codified at 15 USC. Item Without special deduction RM With special deduction RM Monthly rental income 5000 5000 Annual rental income 60000 60000 Rental reduction of 50 for April May and June 2020 RM5000 x 50 x 3 months 7500 7500 Annual gross rental income. It must be provided by the owner himself or through hiring of.

Broadly the PR explains the taxation of. It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and procedure that are to be applied. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia.

GSTR GST ruling. Capital Allowance 25 11. The type of ruling is indicated in the title for example.

Income from Letting of Real Property. This means that in 2022 youll be filing your taxes for YA 2021 that ends on 31 December 2021. TD taxation determination short form ruling LCR law companion ruling.

Youll only be given a few months to file your income tax so be sure to keep all your payslips EA Forms and receipts as youll need them to file your taxes. These services include maintenance and. A Public Ruling as provided for under section 138A of the Income Tax Act 1967 is.

The private letter ruling addresses an S corporation that through its employees and other agents provided certain services regarding rental real estate property it owned. 12004 MALAYSIA Date of Issue. The new 18-page PR comprises the following paragraphs and sets out 20 examples.

12004 issued on 30 June 2004 provides clarification on. A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia. Public rulings are binding advice.

100 Resolution of amount of any payment of income made or apportionment of income or statutory income. It replaces PR 42011 dated 10 March 2011 please refer to our e-CTIM No132011 dated. Replacement Cost of Furnishings 28 13.

INLAND REVENUE BOARD MALAYSIA. If the landlord finds a new tenant and the new tenants rent is equal or higher to your rent your lease is considered terminated and you are no longer liable for the rent. You sell the home for 400000 at the beginning of 2016.

It sets out the interpretation of the. It sets out the interpretation of the Director General. Taxation of Income Arising from Settlements dated 13 August 2021.

Cash or the fair market value of property or services you receive for the use of real estate or personal property is taxable to you as rental income. Rental Income Received in Advance 18 10. You Have a Right to a Receipt If you pay rent in cash or money order your landlord must provide you with a receipt.

A Public Ruling is published as a guide for the public and officers of the Inland Revenue Board of Malaysia.

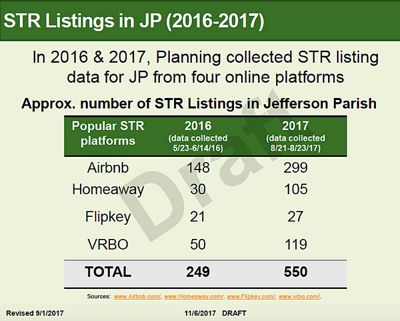

Extra Income Or Neighborhood Nuisance Short Term Rental Rules Weighed In Jefferson Parish Local Politics Nola Com

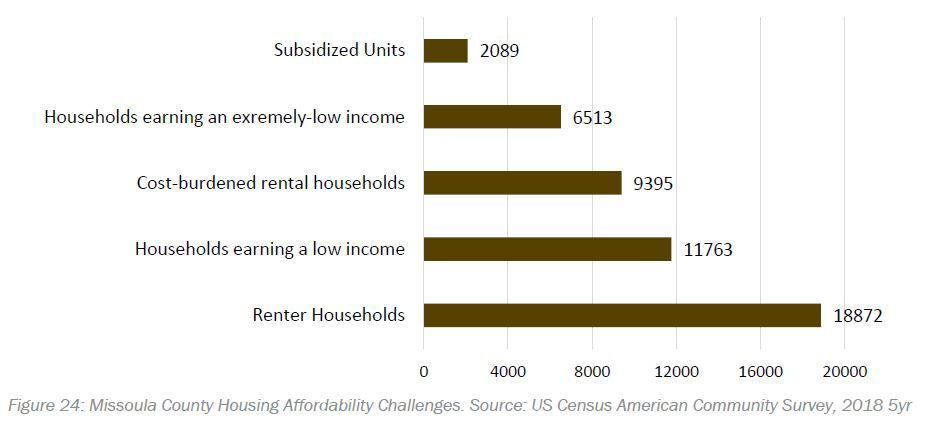

Missoula Officials Address Short Term Rentals Rent Control At Housing Forum Local News Missoulian Com

Click To Enlarge Student Accommodation Toddler Bed Apartment Finder

Tax Consequences Of Charging Below Market Rent Laporte

San Diego Could Soon Get A Vacation From Its Long Running Rental Showdown

Guide To Late Rent Fees For Landlords And Property Managers

What Renters In Pa Need To Know About Available Relief The New Eviction Ban Spotlight Pa

Pin On Social Affordable Housing Issues

Your Questions Answered About Evictions And Rent In N H New Hampshire Public Radio

Does Unemployment Count As Income In Rental Housing Applyconnect

Editorial State S Problems More Extensive Than Pandemic Evictions Marin Independent Journal

Rental Income Tax Treatment For Late Or Unpaid Rent Wipfli

What Happens If I Don T Report Rental Income

Beyond The Moratorium Eviction Courts Must Use Community Navigation To Get Rent Relief To Tenants Quickly Texas Housers

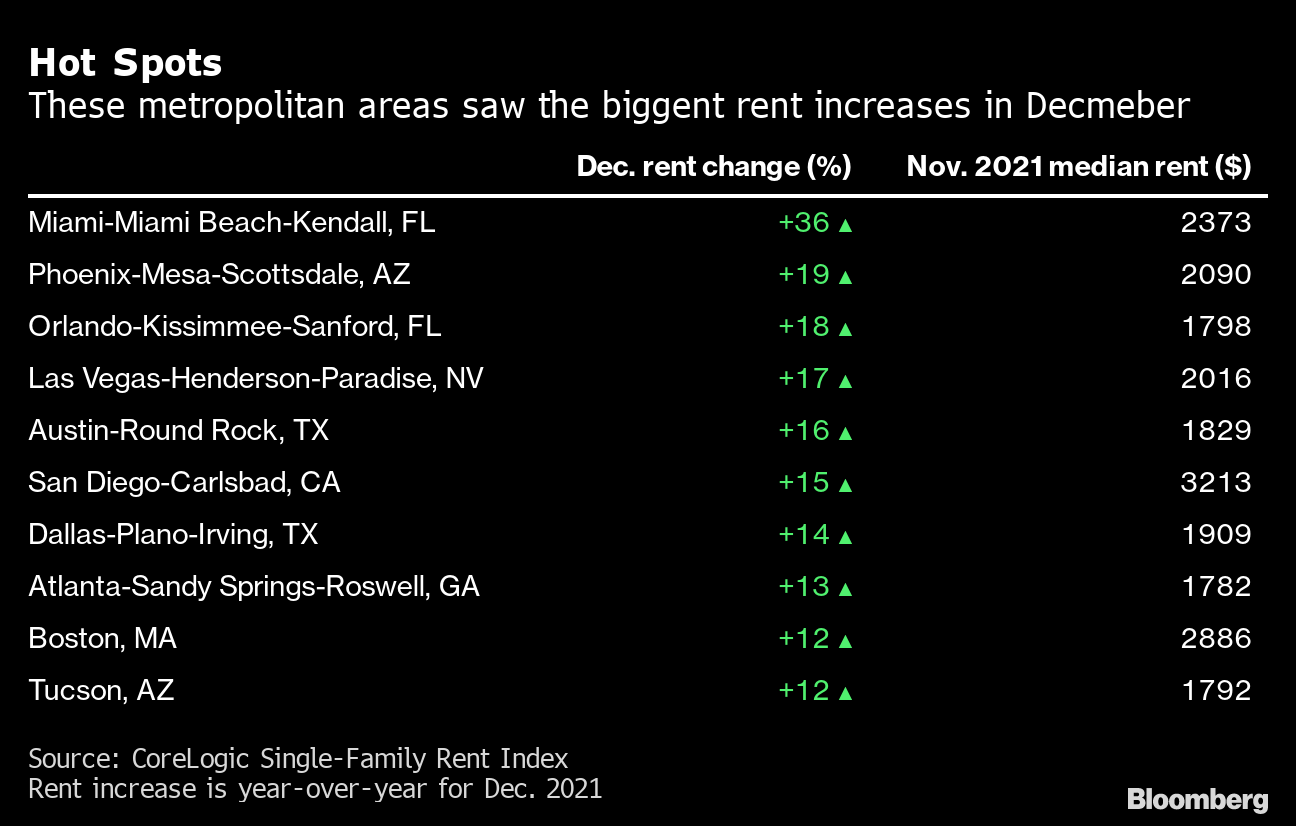

How Much Are Home Rents Rising Prices Surge By Record In Hot Us Housing Market Bloomberg

Prediction For 2030 A Government Take Over Of Rental Housing

City Of Scottsdale Vacation Rentals Short Term Rentals

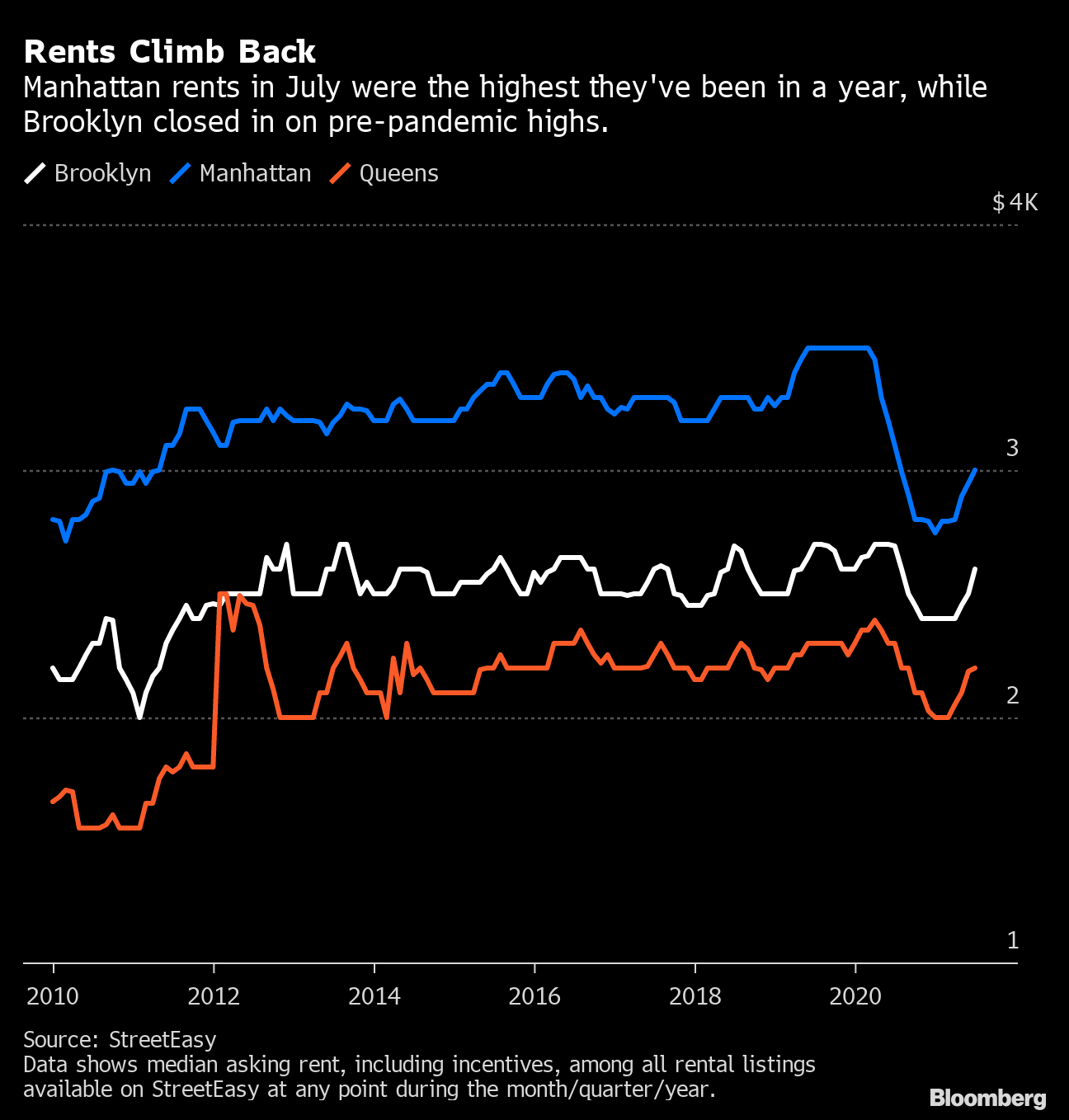

New York City Rents Landlords Jack Up Prices 70 In Lease Renewals Post Covid Bloomberg

/RentalRealEstateDeductions_GettyImages-172793963-05ab9cd106794eb1bae14b7ce93312b1.jpg)